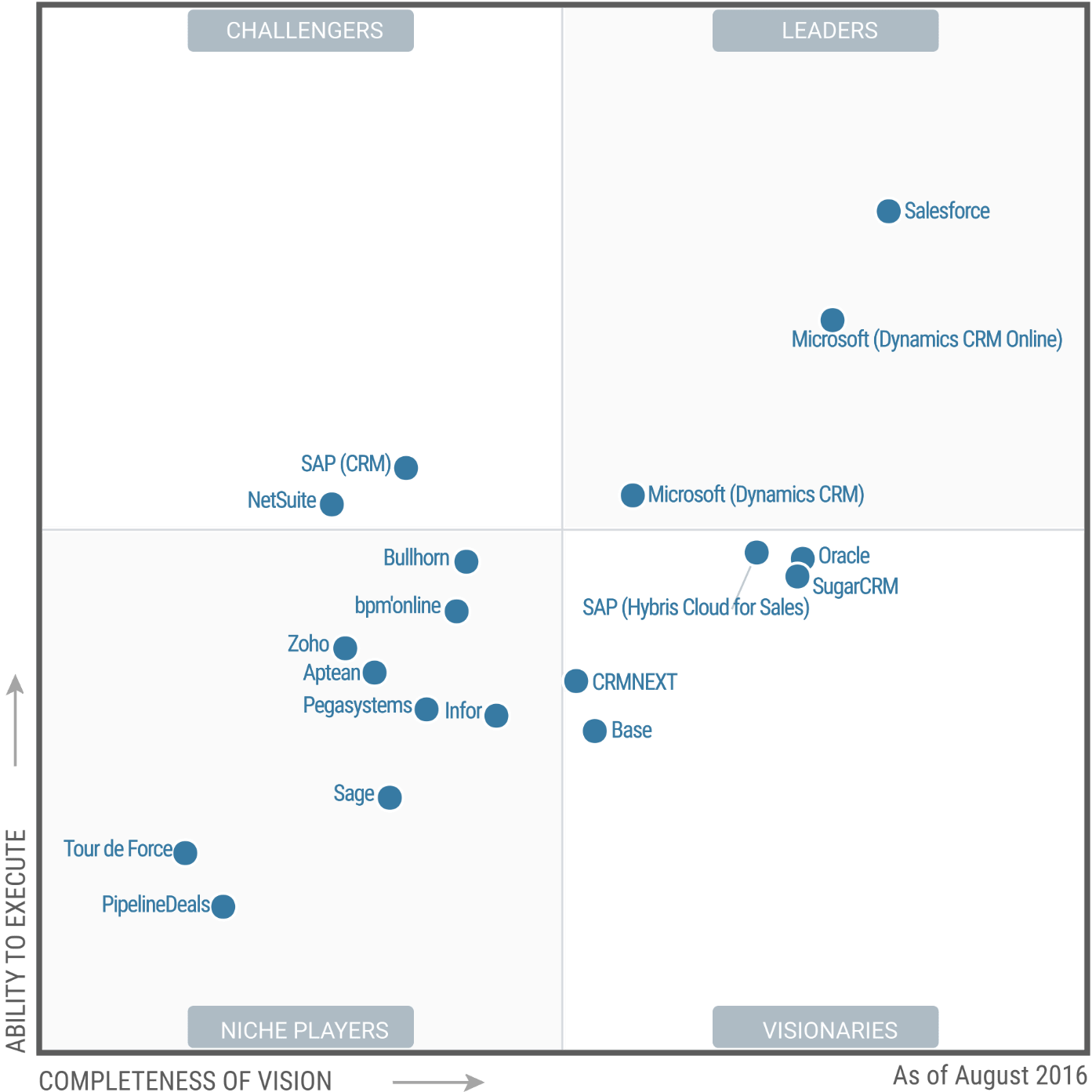

In August 2016, Gartner released its Magic Quadrant for Sales Force Automation (SFA) report comparing 19 SFA products from 17 vendors. According to the report, Salesforce and Microsoft Dynamics CRM Online have retained their positions as industry leaders and visionaries over the years.

But while both are considered industry leaders, which has the most vision and ability to execute?

Below we dive into some of the report’s key findings and analyses so you can be the judge of who comes out on top.

Note: The Magic Quadrant for SFA is not designed to be the sole tool for creating a vendor shortlist. Use it as part of your due diligence and explore the market further to qualify the capacity of each vendor to address your unique business problems and technical concerns.

An Overview of Gartner’s Methodology

Gartner bases its analysis on two factors, which make up its two axes:

- Completeness of Vision: The number of product features and innovative enhancements that are forcing other vendors to react to keep pace.

- Ability to Execute: Revenue, number and quality of resellers and distributors, number of employees and their distribution between engineering, sales, and support and other business issues.

An organization’s placement within these axes determines its role in the marketplace. According to Gartner:

- Leaders execute well against their current vision and are well positioned for tomorrow.

- Visionaries understand where the market is going or have a vision for changing market rules, but do not yet execute well.

- Niche Players focus successfully on a small segment, or are unfocused and do not out-innovate or outperform others.

- Challengers execute well today or may dominate a large segment, but do not demonstrate an understanding of market direction.

When this information is compiled in the quadrant, it provides an at-a-glance understanding of the SFA marketplace.

The Magic Quadrant for 2016

Below is the 2016 Magic Quadrant for Sales Force Automation. For the sixth consecutive year Salesforce and Microsoft Dynamics have held their leadership positions. Why is that? While we have sung the praises of Microsoft Dynamics and we value Salesforce, let’s look at them individually in the context of the Gartner report.

(Photo Credit: Gartner)

An Overview of the Top Leaders

Salesforce

According to the Gartner report, Salesforce is a SaaS-only SFA solution that provides capabilities ranging from mobile sales productivity apps to advanced analytics. The report notes that:

- Salesforce updated its platforms and released new applications in late 2015.

- Salesforce expanded its vision for sales execution by acquiring the CPQ vendor SteelBrick and announcing its intention to acquire the digital commerce vendor Demandware.

Gartner declares Salesforce a leader because:

- The functionality of Salesforce Sales Cloud, which is Salesforce’s cloud-based CRM platform

- Product improvements

- Size of its customer installed base

- Marketing execution

Top Strengths

- Product vision: With recent improvements in mobile sales productivity and platforms, combined with promised capabilities on the Sales Cloud roadmap, Salesforce maintains a strong product vision for sales efficiency and effectiveness.

- Application marketplace: Salesforce has the deepest application marketplace of any SFA vendor, featuring more than 1,000 third-party sales applications. For companies that want to deploy new sales capabilities without extensive custom development, this is a big win.

- Platform: Salesforce continues to have the strongest SaaS platform in the SFA market. Customers cite its strength in customizing, extending and scaling sales processes, and it also rates well for the ability to create custom mobile apps.

Top Cautions

- Perception of value and sales execution: Customers gave Salesforce the lowest score of all providers for perception of product value, as well as comparatively low scores for contract negotiations and pricing flexibility.

- Its Lightning platform: Salesforce has not yet migrated several important Sales Cloud functions onto its Lightning platform, an upgraded version of their CRM. This includes forecasts, personal accounts, several activity functions, and certain opportunity product functions.

- SFA capabilities: Customers cited concerns about Salesforce's relatively low capability in content management. They also voiced concerns about the quality of its Outlook integration, with gaps in advanced analytic capabilities and a lack of mobile offline capabilities on iOS devices.

Microsoft (Dynamics CRM Online)

According to Gartner, Microsoft Dynamics CRM Online remains a leader because of its strong:

- SFA product capabilities

- SFA product vision

- Marketing execution

- End-user satisfaction

Microsoft Dynamics CRM Online is attractive because of its price and relevance to other Microsoft offerings. However, Gartner also notes that what has helped it maintain leadership is Microsoft’s improved ability to sell to sales leaders, as well as:

- A wide range of SFA capabilities that are relevant to sales organizations, both midsize and large

- Microsoft’s acquisition of additional technologies, notably VoloMetrix and FantasySalesTeam

- Microsoft’s acquisition of LinkedIn

Top Strengths

- SFA product vision: Among the leading SFA vendors, Microsoft has a notable vision for how advanced analytics in SFA applications apply to sales execution. Microsoft Power BI advanced analytics and Azure predictive analytics are already embedded into Dynamics CRM Online. In the future, these capabilities will be united with big-data analytics to produce data-driven sales execution benchmarks and identify sales process best practices.

- Platform: Microsoft Dynamics CRM Online offers a highly configurable solution, based on Microsoft's proprietary technology. Customers give high scores for the ability to build custom sales processes with the platform.

- Customer experience: Customers gave it high scores for post-sales customer support and customer success processes.

Top Cautions

- Platform architecture: Microsoft Dynamics CRM Online is supported by two different technology architectures: product configuration architecture and the Azure cloud platform. If you have significant customizations be aware that Microsoft plans to migrate all Dynamics CRM Online services onto Azure.

- Sales strategy: Microsoft needs to improve how it sells to enterprises. It relies on an extensive partner network to source, sell and implement. Some Dynamics CRM Online customers have told Gartner that they had expected better input from Microsoft regarding product implementation and best practices.

- Application marketplace: Compared with other leading SFA vendors, Microsoft offers relatively few sales-specific applications in the CRM App Store.

How can Salesforce and Microsoft Meet Your Specific SFA Needs?

We’re going to expand on one more very important variable: configurator integration capabilities. This is critical to consider because it allows you to more easily customize SFA to your organization. After all, have you seen a sales cycle that is exactly like yours? We didn’t think so.

We’re pleased to report that both Salesforce and Microsoft Dynamics CRM are easily configurable. So it’s painless for you to add features to your SFA that ensures it will optimally support your unique sales cycle. For instance, you can streamline the sales, quote and purchasing process (and drive more productivity and revenue as a result) by adding the Powertrak Configure-Price-Quote Solution Suite to either SFA solution.

We think high configurability is why Microsoft and Salesforce steadfastly remain the marketplace leaders. After all, it’s not the strongest that survive, it’s the most adaptable.

For more information on integrating Salesforce or Microsoft Dynamics CRM Online with CPQ, get in touch with Axonom today.

Next up, we’re going to look at Gartner’s SFA marketplace challengers. Stay tuned!