You’ve heard the sage business advice that it is less expensive to retain customers than to acquire new ones and that existing customers can yield considerably more revenue than many businesses actually capture. Considering the fact that during uncertain economic times customers are more apt to purchase from established, trusted vendor relationships rather than enter into new ones.

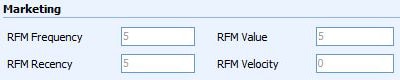

This may be a good time to take a closer look at how to increase profits from your existing customer base and RFM scoring can help. RFM (Recency, Frequency and Monetary) value is a methodology that gives a quantifiable analysis of your customer’s purchasing behavior through a simple numeric score.

This may be a good time to take a closer look at how to increase profits from your existing customer base and RFM scoring can help. RFM (Recency, Frequency and Monetary) value is a methodology that gives a quantifiable analysis of your customer’s purchasing behavior through a simple numeric score.

- How recently has a customer purchased?

- How frequently does a customer purchase?

- What is the monetary value of a customer’s purchases?

- What is a given customer’s velocity (+ or -) relative to the collective base?

RFM scoring is generated by attributing a value to each parameter. Velocity is calculated to show a given customer’s trend, up or down, relative to the midpoint RFM score for all customers. The scores give simple quantitative indicators to identify and segment your customers by their historic buying behavior and trend direction.

Use this information to create unique marketing messages designed to prompt purchasing behavior of customers with similar scores. For example, an offer of bundled products or quantity incentives should be targeted at customers with low monetary but high frequency scores. For retention control initiatives, filter on low (-xxx) velocity scores which indicate customers you’re at risk of losing. Those with high monetary scores, task Account Mangers to follow-up directly. For mid-level monetary scores, send a customized email, place a call, or distribute a mailing campaign to reengage and generate new interest.

RFM scoring is a great tool for the marketing department but should be shared among other departments too. Customer facing employees who have been instructed on what the score values mean to your business can use the information to turn otherwise general customer interactions into new opportunities.

Take for example a scenario where a customer who made a significant purchase long ago but has not been engaged with your organization since, suddenly contacts your Customer Service department. A customer service representative should be able to look up the customer account record in your CRM (Customer Relationship Management) system and quickly see their RFM score which would indicate both risk and opportunity. Along with taking care of the support request, the service rep would know to proactively inform the customer about new products, listen for indications the customer may be shopping for additional products you offer and perhaps find out about new BDM (Business Decision Maker) contacts for sales to reach out to.

At Axonom, we typically find that most businesses have the data for RFM scoring; it’s just a matter of using the right software to generate the scores. Request a demonstration on how to easily segment, rank, and score customers using RFM scoring and track trends over time to see which customers are growing or shrinking in value.